Beggars Group Takes 51% Control of XL Recordings in Strategic Shift

By Trevor Loucks

Founder & Lead Developer, Dynamoi

The era of the "loose confederation" at Beggars Group is officially over. In a move that fundamentally redefines the architecture of the global independent sector, the British powerhouse has acquired majority control of its crown jewel, XL Recordings.

According to new UK filings, Beggars Group paid a surprisingly modest sum to tip its ownership stake from a 50/50 split to 51%, ending a decades-long joint venture structure with label head Richard Russell. This is more than a bookkeeping adjustment; it represents a hardening of the "Super-Indie" model against private equity and major label encroachments.

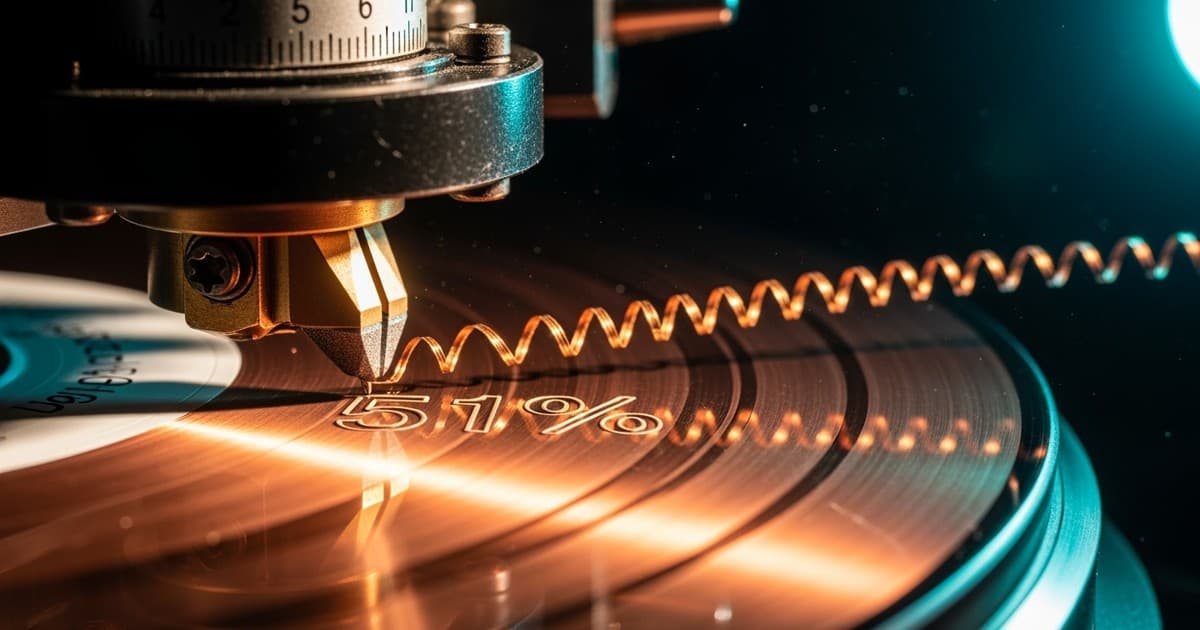

The £2.6M tipping point

For years, XL Recordings operated as a semi-autonomous fiefdom, sharing profits and power equally between Beggars infrastructure and Russell’s A&R vision. The new filings reveal that in October 2024, Beggars paid just £2.6 million ($3.3 million) to acquire the decisive 1% equity needed to take control.

Key insight: The deal reclassifies XL from a joint venture to a subsidiary, allowing Beggars to fully consolidate the label's assets—including the majority of Adele’s discography—directly onto its group balance sheet.

Why the math matters

By moving XL into the subsidiary column, Beggars Group instantly bolsters its financial valuation. The book value of XL’s net assets is listed at £210.7 million ($269 million), with nearly $40 million in cash on hand.

Previously, under the 50/50 structure, these assets sat slightly removed from the parent company's direct financial reporting. Consolidating them gives Beggars massive leverage for credit facilities, acquisitions, and technology investments without needing outside capital. It signals that Chairman Martin Mills is prioritizing asset density and corporate solidity over the flexible partnerships of the past.

A cascading consolidation

The restructuring triggered a domino effect within the group’s holdings. Immediately following the transaction, XL Recordings utilized its own cash reserves to secure its sub-labels. XL paid £200,000 ($255,000) to increase its stake in Young Recordings (formerly Young Turks) to 51%.

This secures long-term rights to another tier of critical catalog, including The xx, Sampha, and FKA Twigs. The result is a unified chain of command: Beggars controls XL, and XL controls Young.

2024 financial scorecard

The structural pivot comes amid a banner year for the group. While many labels struggled with supply chain inflation, Beggars posted a 49% surge in operating profit to $13.4 million (£10.5m) for the 2024 calendar year.

The drivers:

- Revenue Growth: Total revenue hit $140.4 million, up 6.5% year-over-year.

- Physical Strength: High-margin vinyl sales continue to anchor the bottom line, supported by campaigns for Fontaines D.C. and Peggy Gou.

- Catalog Efficiency: The reversion of US rights for Adele’s first three albums (19, 21, 25) continues to pay dividends, as XL no longer splits that revenue with Sony Music.

The estate planning angle

The timing of this consolidation aligns with broader moves regarding the company's future. Control was recently transferred to the MM Settlement Trust, a vehicle connected to Martin Mills.

By locking in 51% ownership of its most valuable assets now, Beggars is "future-proofing" the company. It ensures that the group remains a singular, defensible entity for the next generation, making it significantly harder for components to be picked off individually by majors or investment firms.

About the Editor

Trevor Loucks is the founder and lead developer of Dynamoi, where he focuses on the convergence of music business strategy and advertising technology. He focuses on applying the latest ad-tech techniques to artist and record label campaigns so they compound downstream music royalty growth.